Are you one of the many Indian taxpayers wondering if you should file your income tax return (ITR) when you haven’t crossed the taxable income threshold? Understanding the importance of filing your ITR, regardless of whether you owe tax or not, is crucial. Let’s delve into why it matters beyond just avoiding penalties.

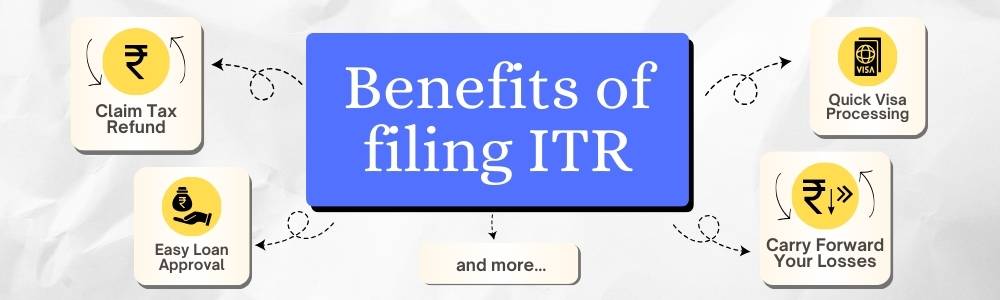

Filing your income tax return isn’t merely a legal requirement but a gateway to financial stability and compliance. It helps in establishing a documented financial record with the government, which can be beneficial for various purposes such as applying for loans, visas, or even claiming refunds for excess tax deducted.

For instance, consider Rohan, a freelancer earning below the taxable limit. Despite not owing any tax, filing his ITR regularly allowed him to showcase his income history when applying for a home loan. It helped him secure a better interest rate and smoother approval process due to his transparent financial record.

Take the case of Priya, who skipped filing her ITR assuming it wasn’t necessary since she wasn’t liable for tax. Later, when she applied for a visa to study abroad, she faced delays and complications due to the lack of documented financial proof, impacting her travel plans significantly.

- Case Study 1: Building Creditworthiness Rajesh, a salaried employee with income below taxable limits, filed his ITR regularly. When he wanted to upgrade his car through a loan, his consistent ITR filings showcased his financial discipline. This helped him secure a favourable loan term and interest rate, thanks to his credible

financial history. - Case Study 2: Claiming Refunds and Adjustments Pooja, a consultant with fluctuating income, diligently filed her ITR every year. Despite not owing tax, she regularly claimed refunds for excess tax deducted at source. These refunds provided her with additional funds for investments and savings, enhancing her financial planning.

Filing your ITR doesn’t have to be daunting. Follow these simplified steps to ensure compliance:

- Gather Documents: Collect your PAN card, Form 16/16A, bank statements, and investment proofs.

- Choose the Correct Form: Select the appropriate ITR form based on your income sources.

- Fill in Details: Enter your income, deductions, and tax liability accurately.

- Verify and Submit: Review your form for errors, verify using Aadhaar OTP or digital signature, and submit online.

In short, filing your income tax return is more than a regulatory obligation; it’s a strategic move towards financial empowerment and compliance. Whether you’re a salaried individual, freelancer, or business owner, timely filing of ITR builds credibility, facilitates financial transactions, and safeguards against legal penalties.

Remember, even if you don’t owe tax, filing your ITR demonstrates responsible citizenship and unlocks avenues for financial growth. Stay informed, stay compliant, and reap the benefits of financial prudence.